Forensic Accounting & Auditing Investigations (FAI)

Forensic Accounting (FA) is the study and evaluation of financial documents to gather evidence to establish any fraud or wrongdoing by a person / society / company / organization for committing fraud, embezzlement, cheating, misappropriation or any other financial or economic offences.

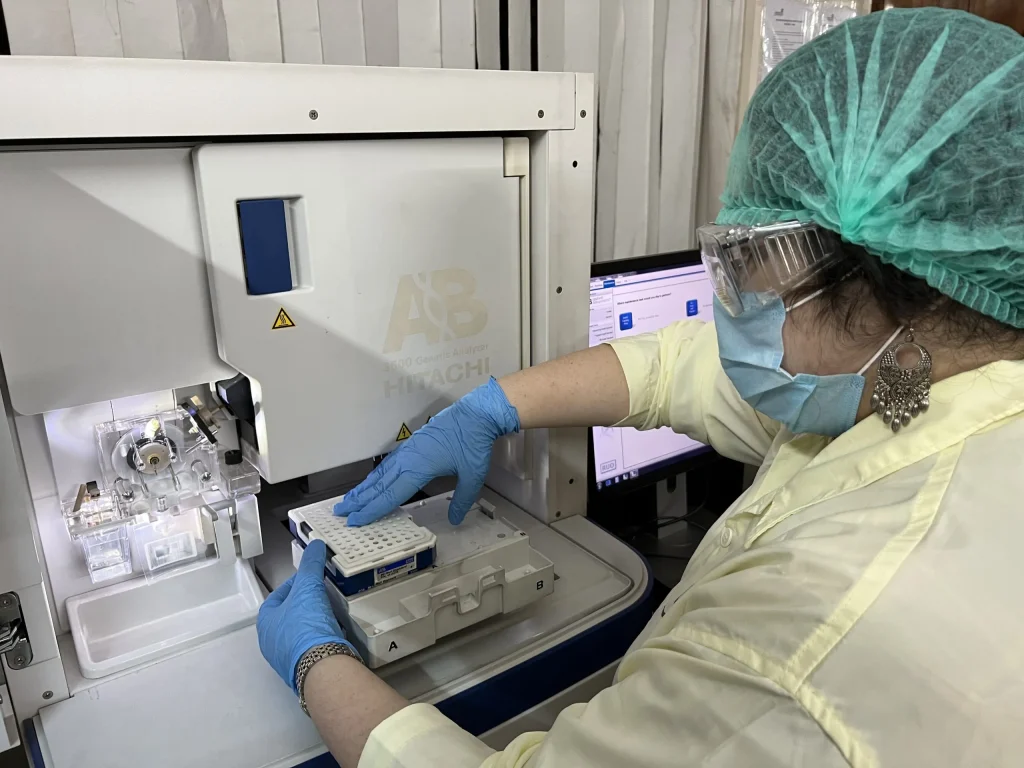

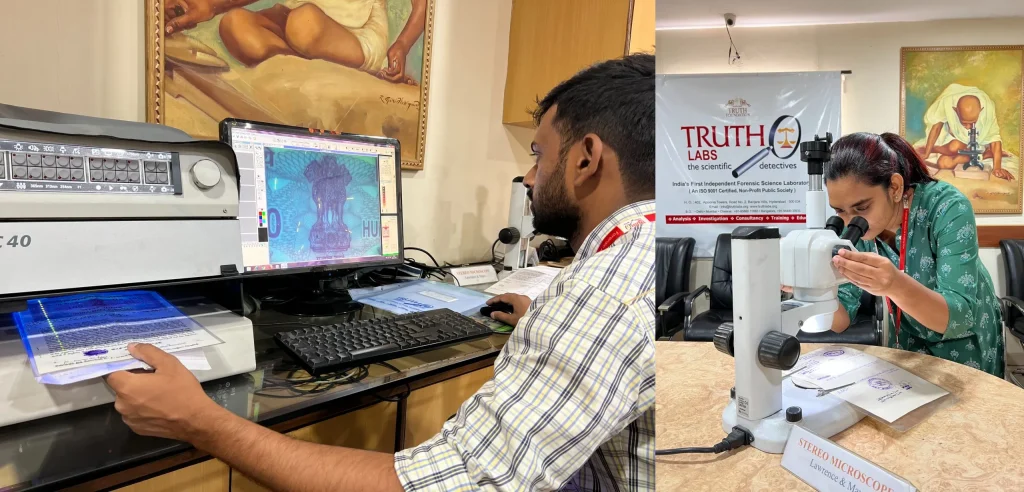

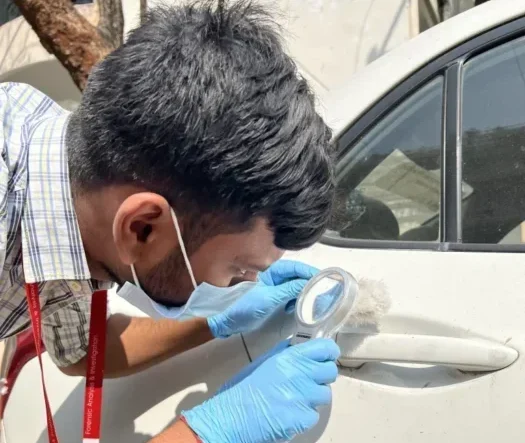

The common procedures adopted include critical analysis of financial procedures, retrieval of data from computer, examination of documents relating to accounting, auditing, followed by conducting interviews with the people associated besides investigation into the nature and circumstances that led to financial frauds using advanced computer software and hardware.

Truth Labs collaborate with businesses, creditors, and bankruptcy trustees to investigate possible fraud or mismanagement of assets in business bankruptcies or other situations involving economic losses. Also liaise with attorneys and clients to investigate cases of possible fraud or misappropriation of assets in divorce or other family disputes.

Truth Labs engages qualified team of forensic accountants who collects data on assets that have been transferred or concealed by an individual or business, investigate the claims to determine their validity, money laundering, follow the regulations of the Securities and Exchange Commission (SEC) and Finance Industry Regulatory Authority (FINRA) to investigate cases of possible securities fraud, work with the IRS and local government to investigate cases of possible tax fraud and etc.

Truth Labs undertook Forensic Audits to find possible risks and vulnerabilities in the existing systems of a few companies and carried out investigations in the banks, financial institutions, industries, business establishments and fraudulent insurance claims made by commercial organizations.

Related Posts

No posts found!